“We have always done things that way”, “nothing needs to be changed as everything is already working now” – are those thoughts familiar do you also? If Michael Dell was not eager to find new and better solutions, Dell computers would look like that when the company produced the first computer of its own design in 1985, the Turbo PC.

PC’s Limited founder Michael Dell Source: https://www.computerhistory.org/timeline/1985/

Those were fine working machines, but you do agree that they can`t perform like modern computers. Then why you still want to use the software that origins from 1985?

Accountants are not risk takers by nature – everything needs to be double-checked and analyzed correctly, by themselves. But we trust e-banking in the same way if we were sitting at the teller's desk in the bank, don`t we? So, reducing tedious and error-prone collaboration between clients and their accountants, avoiding time-consuming book-keeping and bank account reconciliation, and switching from manual processes to streamlined automation are essential steps towards higher profitability and innovation.

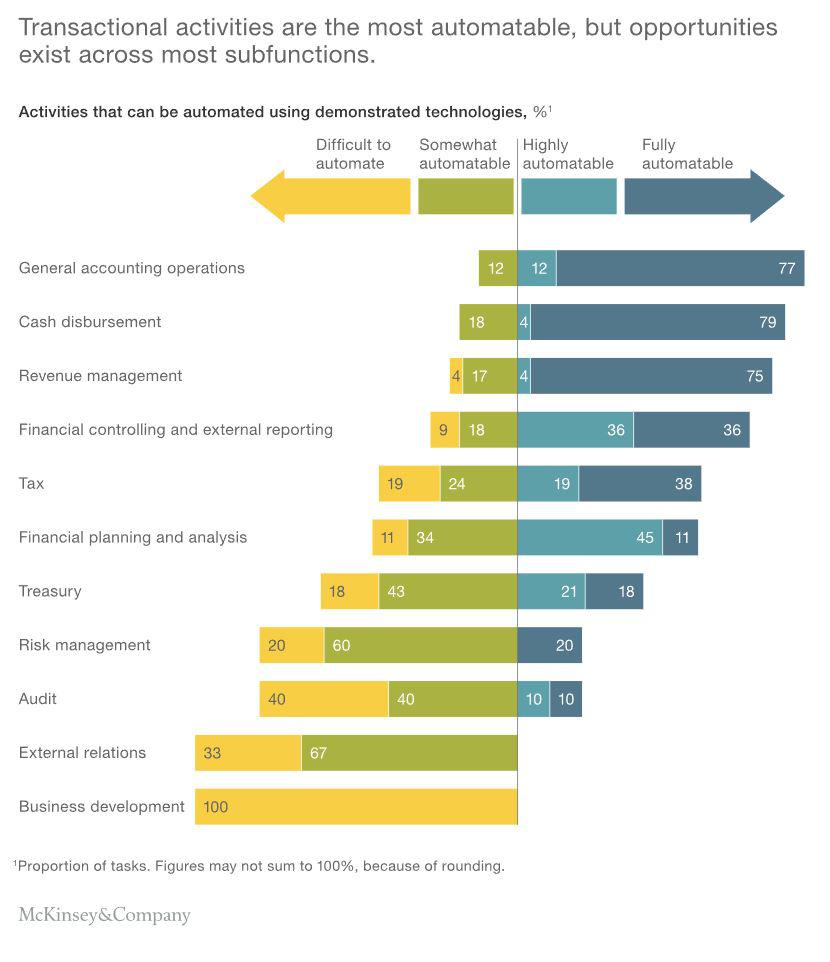

A report from McKinsey found that most of what accountants do are actually either highly or fully automatable.

If you can automate things, you have more time to deal with external relation and support and business development – the activities that are difficult to automate.

It feels that if you do things the way others are doing, then it is safe from stakeholders’ point of view also. Clients expect advisory services, tax knowledge, and consulting. Clients nowadays expect the same advice big companies have access to. Modern digital technologies allow automated data processing and extraction of useful information to deliver added value via consulting and knowledge sharing. Accountants have still the needed knowledge.

Accountants tend to perceive that regulation can be an obstacle to adopting digital automation solutions. A survey in September 2020 in 12 EU Member States showed that actually it does not appear to be a significant obstacle at all. However, the most striking outcome is that actually…

… shortage of ICT and digital skills emerges as a significant barrier to automation. One possible explanation could stem from the nature of digital automation in this profession, which demands specific ICT skills that are not embedded into the conventional educational path of an accountant, and would thus require investment in dedicated staff or additional training. Regarding to specific regulations, qualification requirements appear to be the most strongly related to the choice to opt for digital automation and therefore represent the largest obstacle. The qualification required to practice the profession does not provide significant digital skills required to implement digital automation tools. Specialization in the activities reserved for accountants might represent a skill mismatch and thus an obstacle to expand abilities, effort and skills into digital transformation.

Sign up for newsletter to get more ideas for innovation in accounting and more.